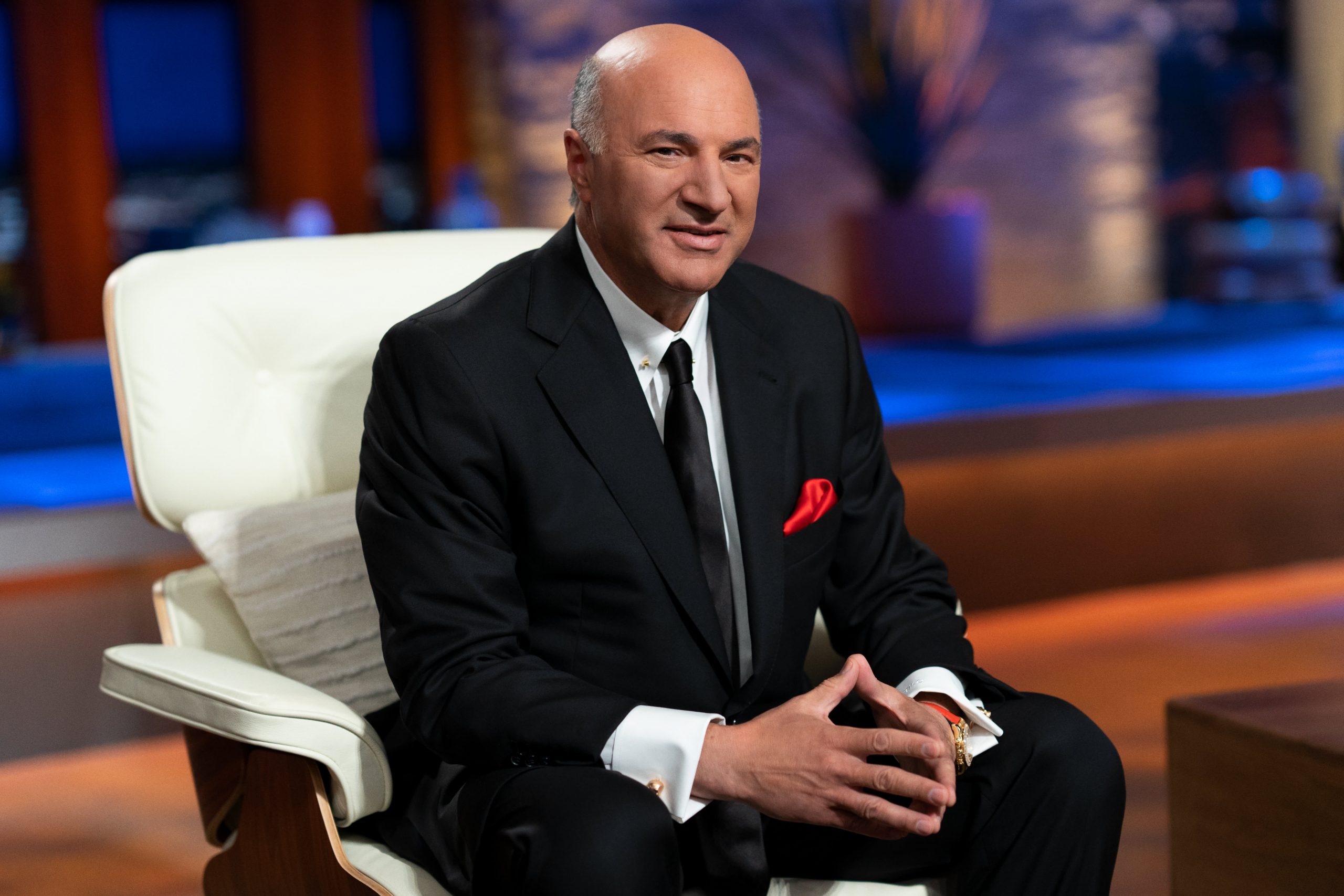

Corporate boards across the nation are closely examining the recent social scandal that has resulted in a staggering $15 billion loss in market capitalization for retail giant Target, according to renowned investor Kevin O’Leary. In an exclusive interview with Fox News, O’Leary, also known as a star investor on the hit TV show “Shark Tank,” expressed his concerns about the ramifications of Target’s mishandling of a Pride merchandising controversy.

Since the backlash erupted over Target’s ill-fated decision, the company’s market value has plummeted by over $13 billion, leaving its total worth at $60.24 billion as of Monday’s closing price. O’Leary, the head of O’Leary Ventures, emphasized that this turn of events could lead to a paradigm shift in how corporate America approaches various societal concerns, particularly the processes that led to Target’s unprecedented downfall.

O’Leary shared his perspective on the delicate balance companies must strike when addressing diversity-related issues. “On one hand, companies want to showcase their support for diversity and participate in the ongoing societal discussions,” he explained during an appearance on “Jesse Watters Primetime.” However, from the standpoint of investors and individuals who own shares in the S&P 500 or Target stock, there is growing concern that businesses may be losing sight of their primary objectives: serving customers, prioritizing employees, and ensuring shareholder value.

“If a company strays too far from its core mission, the market has proven time and again that it will severely penalize them,” O’Leary cautioned. The recent incident at Target has awakened boards across the corporate landscape, prompting a renewed focus on aligning business decisions with the best interests of all stakeholders involved.

The ramifications of Target’s controversial merchandising move have been profound, and the fallout should serve as a stark warning for other companies. Corporate leaders now recognize the significant financial risks associated with mishandling sensitive societal issues, as demonstrated by the drastic erosion of Target’s market value.

As O’Leary observed, “It’s not just about taking a stance on societal matters; it’s about doing so in a manner that doesn’t alienate your core customers, employees, or shareholders.” The delicate balancing act requires careful consideration of the potential consequences before embarking on any high-profile initiatives.

The business landscape is evolving rapidly, and companies must adapt to the changing expectations of their stakeholders. The recent turn of events surrounding Target underscores the need for corporations to prioritize strategic decision-making that encompasses the interests of all parties involved.

In conclusion, Target’s mishandling of the Pride merchandising controversy has come at a significant cost. The $15 billion loss in market capitalization serves as a stark reminder of the risks associated with neglecting the core objectives of a business. Moving forward, corporate America must strike a delicate balance between societal concerns and the fiduciary responsibilities owed to shareholders, customers, and employees.