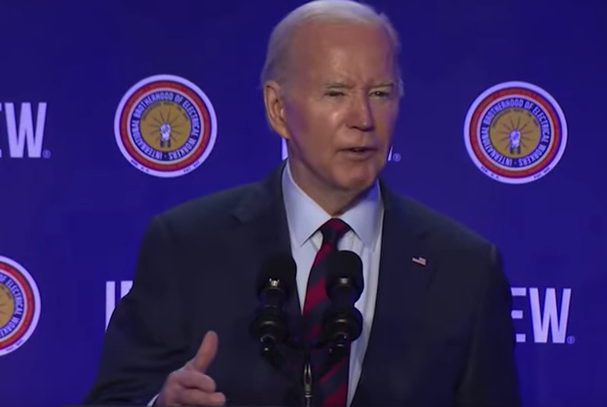

President Biden has issued a bold ultimatum: if re-elected, he pledges to allow former President Donald Trump’s 2017 tax cuts to expire next year, effectively raising taxes for middle-class and low-income Americans. However, his statement sparked immediate backlash and a rapid backtrack from his aides.

In a recent speech, Biden unequivocally declared that if re-elected, he would allow Trump’s tax cuts to expire next year, leading to higher taxes for many Americans. This bold assertion immediately sparked heated debate and scrutiny, with critics questioning the potential economic and political ramifications of such a move.

The TCJA has long been a contentious issue, with proponents touting its role in bolstering economic growth and job creation, while opponents argue that it disproportionately benefits corporations and the affluent. Biden’s announcement to let the tax cuts lapse underscores his administration’s commitment to addressing income inequality and implementing policies to support working families.

Nevertheless, Biden’s stance on the TCJA has faced criticism from various quarters, with detractors accusing him of jeopardizing economic stability and discouraging investment by proposing tax hikes. Moreover, the prospect of increased taxes for middle-class and low-income Americans has raised concerns about its impact on consumer spending and household finances, particularly amidst escalating inflation and economic uncertainty.

In response to the backlash, Biden’s aides swiftly moved to clarify his position, emphasizing the need for comprehensive tax reform that prioritizes fairness and equity. They reiterated the administration’s commitment to crafting policies that foster economic growth while ensuring that corporations and the wealthiest individuals contribute their fair share.

The debate over the fate of Trump’s tax cuts underscores the broader ideological chasm in American politics, with Democrats advocating for progressive taxation and income redistribution, while Republicans champion tax cuts and deregulation to stimulate economic growth. As the 2024 presidential election looms, tax policy is poised to remain a focal point of political discourse, shaping the trajectory of the nation’s economy and fiscal agenda.

In conclusion, President Biden’s resolute stance on allowing Trump’s tax cuts to expire has ignited a contentious debate over the future of tax policy in America. While some applaud his efforts to address income inequality and promote fairness, others caution against the potential economic repercussions of raising taxes. As the nation grapples with these complex issues, the outcome of this debate will have far-reaching implications for the economy and the well-being of the American people.