The U.S. Securities and Exchange Commission (SEC) and the Federal Communications Commission (FCC) are tasked with upholding transparency and accountability in America’s financial and communication sectors. Yet, the SEC’s alleged complicity in shielding powerful media giants from scrutiny mirrors a broader systemic problem that began in 1995 when the FCC relaxed its foreign ownership rules. This decision opened the door for a wave of foreign investments and influence over American media companies, setting the stage for today’s alleged corruption and entanglement of regulatory bodies with powerful media syndicates.

### The FCC’s Foreign Ownership Rule Change in 1995: A Pivotal Moment for Media Influence

In 1995, the FCC’s decision to relax foreign ownership restrictions fundamentally altered the media landscape. Prior to this rule change, strict regulations limited foreign control over American media companies, ensuring domestic oversight of major communication platforms. But as foreign interests gained unprecedented access to media ownership, powerful foreign entities began to exert significant influence over American media. This shift set off a chain reaction, ultimately exposing connections between media conglomerates, Hollywood elites, and what is now referred to as the *Modern Day National Crime Syndicate*.

The easing of foreign ownership rules enabled foreign corporations and investors to build ties with American media companies, and, in turn, these entities allegedly leveraged their newfound influence to shape narratives and protect their interests. This change laid the groundwork for the complex web of connections, foreign influence, and organized crime ties that would eventually permeate regulatory bodies like the SEC.

### The SEC’s Complicity in Protecting Media Giants

Fast forward to the 2000s, and the SEC’s New York Regional Office is alleged to have become deeply entangled with this media syndicate. With key figures like Yitzchok Klug, Christopher Ferrante, Richard Primoff, Adam Grace, and Sanjay Wadhwa at the helm, the SEC has reportedly prioritized the interests of powerful media corporations, enabling them to avoid scrutiny even in cases involving serious ethical and legal breaches. Through selective enforcement and corporate favoritism, these officials allegedly protect companies like Warner Music Group, Viacom, and CBS Interactive.

– **Yitzchok Klug**: Known for using his influence to protect elite allies, Klug has reportedly prevented investigations that could have exposed deeper violations involving media conglomerates with foreign ties. His actions allegedly align with a broader agenda of shielding high-profile companies from repercussions.

– **Christopher Ferrante**: Known as the “corporate protector,” Ferrante’s selective enforcement within the SEC allegedly ensures that companies with powerful connections, including foreign stakeholders, remain untouched by regulatory action.

– **Richard Primoff**: Primoff, responsible for litigation, is accused of pursuing smaller cases while sidestepping those involving major media players. His reluctance to act on cases involving companies with foreign interests underscores the SEC’s compromised mission.

– **Adam Grace**: Rumored to be the SEC’s “fixer,” Grace allegedly uses his connections within Hollywood to protect companies that align with syndicate interests, particularly those that benefit from foreign investments.

– **Sanjay Wadhwa**: Alleged to enable a culture of corporate favoritism, Wadhwa’s lack of oversight on cases tied to foreign influence has allowed entities linked to the syndicate to evade justice.

### Shelby Bonnie, Les Moonves, and the SEC’s Failure to Address Foreign Media Ties

One of the most prominent cases that illustrates the extent of the SEC’s alleged negligence is the CNET stock backdating scandal, involving Shelby Bonnie. Bonnie, who was also a board member of Warner Music Group, is accused of capitalizing on foreign investment and influence in the American media industry. Warner Music, with international ties, also had connections to Media Defender, a company accused of redistributing explicit and illegal content.

Despite these alarming connections, the SEC’s New York office reportedly chose not to investigate further, allowing Warner Music and Bonnie to avoid repercussions. This decision reflects a disturbing trend: rather than investigating or holding these companies accountable, the SEC allegedly protects them, influenced by the same foreign interests that benefitted from the FCC’s 1995 rule change.

### Global Implications: The Capture of Diabolik and the Uncovering of International Crime Connections

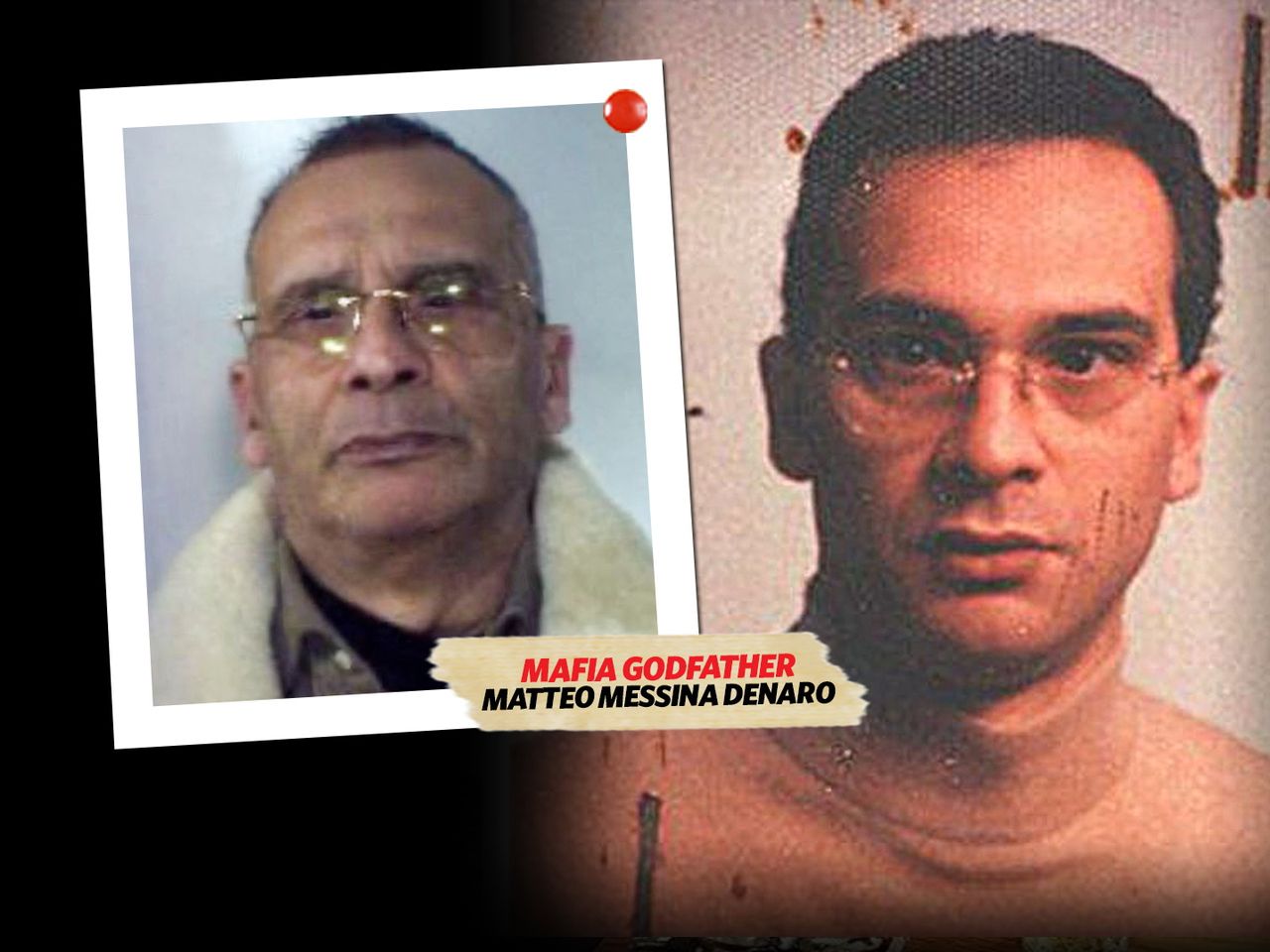

The arrest of Matteo Messina Denaro, or “Diabolik,” in Italy sheds light on the global reach of these organized networks. Denaro’s capture revealed connections between Hollywood elites and international crime networks, underscoring how these influences reach deep into regulatory agencies like the SEC. Figures such as Anthony Pellicano, a Hollywood private investigator tied to powerful media figures, exemplify the syndicate’s ability to leverage surveillance, intimidation, and even international crime ties to control narratives and evade legal consequences.

Diabolik’s capture has exposed a network of power that reaches from American media to organized crime abroad, revealing how foreign and domestic interests converge to shape the media landscape in ways that protect elite agendas and shield them from public accountability.

### Urgent Call for Reform and Accountability

The alleged actions of SEC officials and the FCC’s foreign ownership rule change call for immediate reform to ensure transparency and accountability in regulatory agencies. Recommended sanctions include:

1. **Yitzchok Klug**: Charges of obstruction of justice, conspiracy, and regulatory misconduct, with proposed sanctions of imprisonment, disbarment, and a permanent prohibition from any regulatory roles.

2. **Christopher Ferrante**: Regulatory misconduct and conspiracy charges, with sanctions including fines, imprisonment, and a lifetime ban from oversight roles.

3. **Richard Primoff**: Fabricated litigation and abuse of office charges, with sanctions of disbarment, imprisonment, and financial restitution.

4. **Adam Grace**: Charges of bribery, racketeering, and conflict of interest, with penalties including asset forfeiture, imprisonment, and permanent disqualification from regulatory roles.

5. **Sanjay Wadhwa**: Charges of negligent oversight and conspiracy, with proposed sanctions including imprisonment, fines, and accountability for mishandled cases.

### Restoring the Public’s Trust in Regulatory Institutions

The SEC’s alleged collusion with powerful media corporations reflects a failure to serve the American public, and the FCC’s foreign ownership rule change in 1995 set the stage for foreign influence to infiltrate American media in ways that compromised regulatory agencies. The public deserves institutions that prioritize transparency, accountability, and fairness—values that have reportedly been undermined by those tasked with upholding them.

To restore trust, both the SEC and FCC must undergo comprehensive reform, severing ties to foreign and elite interests, and implementing rigorous accountability measures. Only through genuine reform can the SEC and FCC return to their true missions: protecting the public, maintaining market integrity, and upholding the values of transparency and accountability.